Getting married, entering a domestic partnership, or even deciding not to combine finances is a personal decision. But once your relationship status changes, the IRS pays attention-for better or worse.

After all, the IRS doesn't care how romantic the engagement was or how long you've been together. It cares about filing status, income, dependents, and who's legally tied to whom as of December 31.

The Tax Implications of “I Do”

Marriage is the most straightforward relationship change in the eyes of the IRS-and the one with the biggest potential tax impact. That means, if you're married by December 31, you're considered married for the entire tax year. And, since there's no option to file as "single" for part of the year, come Tax Day, you'll file as either "Married Filing Jointly" or "Married Filing Separately." (Similarly, a breakup or divorce finalized before December 31 also changes your filing options.)

The Marriage Penalty (Yes, It’s a Thing)

Getting married doesn't always lower your tax bill. In some cases-especially when both spouses earn similar, higher incomes-your combined federal taxes may be higher than what you paid as two single filers.

This can happen because combining incomes can cause certain tax breaks to shrink or disappear once your total income passes specific limits. Even if your tax bracket doesn't change much, credits and deductions may phase out faster for married couples filing together.

The good news is that Oregon does not have a state-level marriage penalty. The state's tax brackets are structured so that married couples aren't pushed into higher state tax rates simply because they got married. So, any "marriage penalty" you might experience would typically show up on your federal return, not your Oregon return.

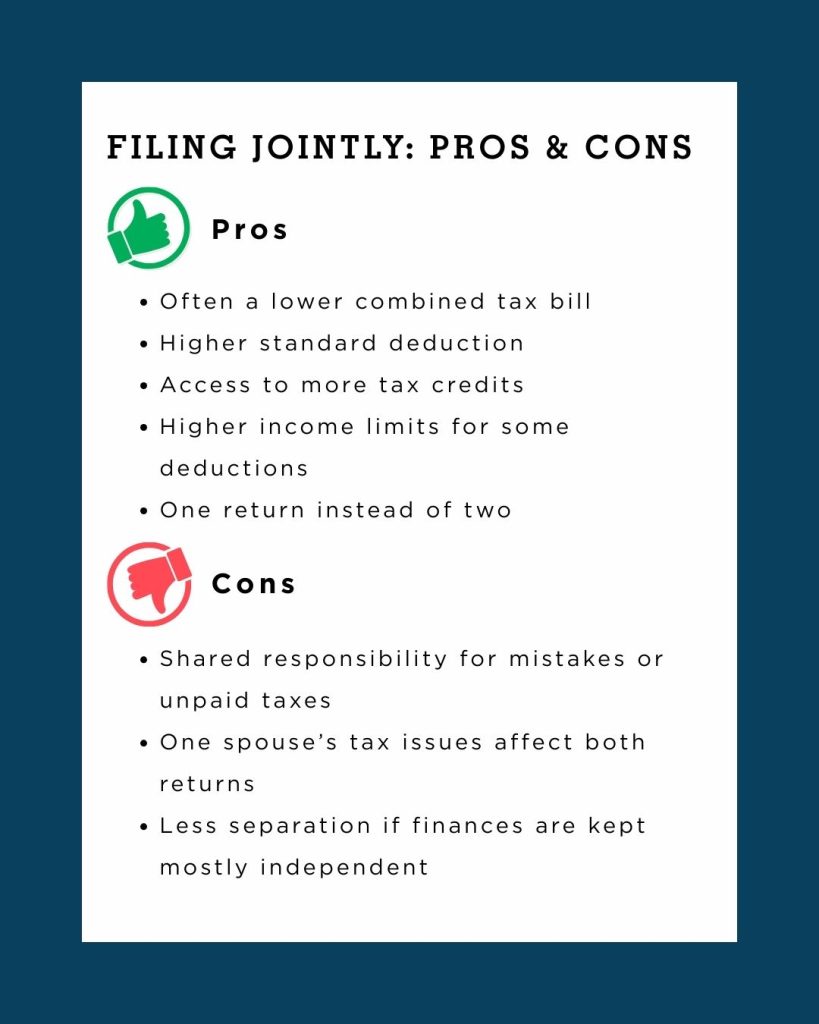

Married Filing Jointly vs. Separately: Not Just a Checkbox

When you’re married, you have a choice in how you file your taxes—and that choice can have a real impact on what you owe. In most cases, you’ll end up paying less in taxes if you and your spouse file jointly. According to TurboTax, filing together could “net you a bigger Standard Deduction, reducing your taxable income—$31,500 for most couples under age 65 in 2025, which increased from $29,200 in 2024.”

Married Filing Jointly

Couples who file jointly may also have an easier time qualifying for certain tax credits, including:

- Earned Income Credit

- American Opportunity and Lifetime Learning Education Tax Credits

- Exclusion or credit for adoption expenses

- Child and Dependent Care Credit

Filing jointly also comes with higher income thresholds for some taxes and deductions, meaning you may be able to earn more and still qualify. Still, not every couple benefits the same way. Filing status can affect credits, deductions, and overall tax liability, so it's worth weighing the trade-offs before deciding.

Married Filing Separately

On the other hand, filing separately may be worth considering if:

- One spouse has significant student loan debt and is on an income-driven repayment plan

- One spouse has unpaid taxes, past filing issues, or audit concerns

- There’s a need to keep finances and tax liability more clearly separated

- One spouse has unusual or high medical expenses that could be easier to deduct on a separate return

The trade-off is that filing separately often means giving up access to certain credits and deductions—and in some cases, paying more overall.

Still, for couples managing complex financial situations, the added clarity or protection can outweigh the cost. Running the numbers both ways before filing can help you decide which option makes the most sense for your situation.

Domestic Partnerships: Where Oregon and the IRS Don’t Agree

Marriage is straightforward in the eyes of the IRS. Domestic partnerships are not. The state of Oregon recognizes registered domestic partnerships, granting partners many of the same state-level rights and responsibilities as married couples. When it comes to taxes, though, state and federal rules don't always line up, and that disconnect can create confusion.

At the federal level, domestic partnerships aren’t treated as marriage, which means filing jointly with a domestic partner isn’t allowed for federal taxes. So, each partner must file a separate federal tax return.

At the Oregon state level, however, registered domestic partners are treated more like married couples and may be required to combine income and deductions when filing their state return.

In practice, that often means extra steps-and careful math. And, because Oregon's tax return often builds off federal figures, domestic partners may need to:

- Allocate income and deductions between two federal returns

- Recombine those figures for the Oregon return

- Track who paid for what throughout the year

This is especially important when partners share expenses, benefits, or dependents. What looks simple in day-to-day life doesn't always translate cleanly at tax time.

If Share Finances but Aren’t Married

Even without marriage or a domestic partnership, sharing finances can affect your taxes. Joint bank accounts may generate interest that needs to be reported, and shared investments often require clarity around ownership and gains.

Co-parenting can add another layer of complexity, since dependents can only be claimed by one person on a tax return. These decisions are less about romance and more about documentation-and making sure everyone is on the same page before tax time. Keeping clear records throughout the year makes these choices much easier when it's time to file.

How to Avoid Surprises

Marriage and domestic partnerships are personal milestones, but they come with financial consequences that last long after the celebration. Your relationship changes don't have to turn into tax headaches, but they do require planning. Before your status changes, review your tax options, and if you have dependents, a high income, or complex assets, consider professional guidance.

After you are married or partnered, keep clear records of your finances, both shared and individual. It also helps to run the numbers both ways before choosing a filing status. Understanding how your relationship status affects your taxes can help you save money-and avoid unnecessary surprises.

Want more tax tips?

- Learn what to do if your W-2 or 1099 is missing.

- Read about the most common tax season scams.

- Discover the most common (and costly) tax mistakes.